Cyber Liability Insurance NJ

What is Cyber Liability Insurance?

There are all kinds of terms to describe the same exposure including Cyber Liability, Privacy Liability, Security & Privacy liability, Data Breach, Network Security and Cyber Security Insurance to name a few.

All of these names focus on your exposure to a data breach. A data breach can occur when personally identifiable information is compromised by hackers, a faulty transaction, malfunctioning technology, simple human error and even lost or improperly disposed data.

The effect of a data breach on your small business could be devastating. You will have to pay to notify the affected individuals as well as the potential expenses arising from credit monitoring, identity theft resolution, analysis into how the data breach occurred and any steps needed to avoid another occurrence. These costs can be heavy and time consuming to identify. Security and Privacy Liability Insurance, also known as Cyber liability protects businesses in the event of a costly data breach

Cyber Liability FAQ

What Is Included in the CyberLiability Coverage?

- Third party liability for financial loss, mental anguish, mental distress and any breach related to claims.

- First party coverage for breach related expenses

- Full limit coverage for notification, credit monitoring and computer forensic expense

- Coverage for breach costs available outside of the policy limit

- Coverage available for business interruption, lost income and restoration of data post breach

- Breach of contract coverage

- PCI fines, penalties and remediation expenses

- Regulatory coverage for all state, federal, foreign, and privacy related regulations (PCI, HIPAA, EU, etc.)

- Primary limits available up to $20 million (higher limits available through excess)

- Retentions starting at $1000

- Coverage can be combined with E&O

- In house quoting system for risks up to $100 million

- Coverage to indemnify third party vendors or clients for breach expenses

- Notification costs are covered when required by law and on a voluntary basis

- Free risk management services provided to policyholders

Coverages Available

Schumacher Insurance Agency is proud to be able to offer competitive quotes for all your Cyber Liability / Data Breach needs including but not limited to the following:

Hacker Damage

Cyber BI & Income

Multimedia Liability

First Party Breach Costs

Third Party Liability

What Are Some Examples of CyberLiability Claims?

Restaurant Chain

Ex.: Breach of Payment Systems

A local restaurant chain discovers that their payment systems have been breached over the course of three months. Tens of thousands of customers had their credit card information stolen, resulting in fraudulent charges on the victims accounts. Victims band together and sue the restaurant chain for costs incurred, including paying for credit monitoring, recovering lost funds and expenses incurred in clearing their identities.

Law Firm

Ex.: Lost Computer

A law firm hired a local contractor to repair some flood damage in a storage area after a storm. The contractor removed and improperly disposed of a server being stored in the area. After the law firm discovered that the server was gone they determined that the server was holding the names, addresses, payment information, legal history, and healthcare info for 800 clients. After hiring tech consultants to identify data stored, notification, credit monitoring and PR the insured’s final costs were $50,000

Healthcare Facility

Ex.: Rogue Employee

A rouge employee sold documents containing names, addresses and social security numbers for patients. Almost 50,000 individuals had to be notified to comply with HIPAA regulations. The breach cost the carrier $12,000 for fines, $6,500 for forensics, $14,500 to print and mail letters to notify, $300,000 for credit monitoring expenses, $45,000 for call center, and finally $50,000 for PR expenses. Final cost to carrier: $428,000

Insurance Agency

Ex.: Stolen Computer

A computer was stolen from an insurance agency containing names, addresses, email addresses, and social security numbers of 8,231 individuals. There was no evidence that the information was accessed or sold but the agency was required to notify under the applicable state regulations. Total expenses paid by the insured: $493,860

Why Have Cyber Liability Insurance?

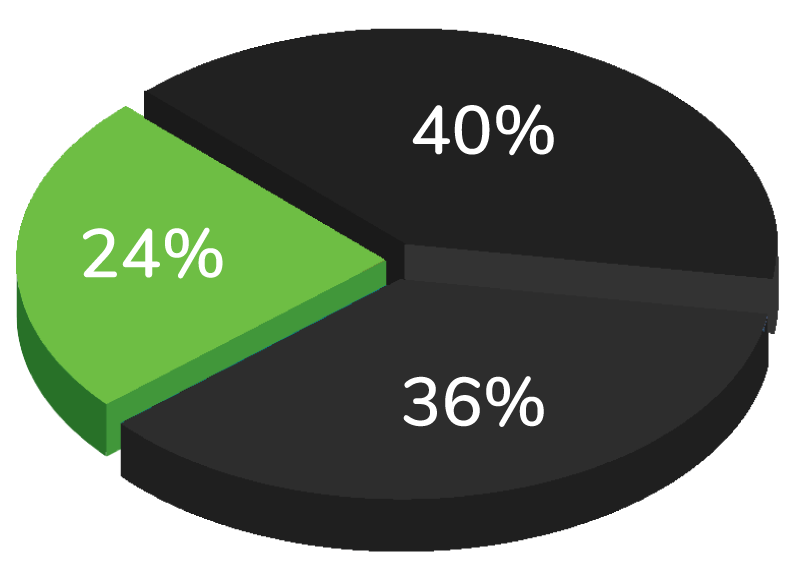

You will be hacked, it is not a matter of if, but when. Data breaches occur every day. While hacking incidents are the most recognizable and expensive cause of data loss, they are not the most common. It’s a startling fact – simple human error accounts for three out of four incidents.

40% of the data breach cases are from people making mistakes, such as losing laptops and flash drives.

36% are system glitches, such as software updates, which inadvertently expose sensitive private files

24% are malicious and criminal attacks

What are the Costs Associated with Data Breach Exposure?

Claims for failure to protect information, expense of legally required notifications and credit monitoring to those whose information is exposed, forensic expense to find out and resolve what happened, public relations expense to maintain business reputation, regulatory and payment card industry fines and hacker extortion demands.

Small business owners have gone out of business due to identity thieves impersonating their business and personal name leading to loan defaults, inability to access credit and loss of business reputation.

Extortion

Bankruptcy

Why You Need Cyber Liability:

- Federal government regulations such as HIPAA, HITECH, and Gramm-Leach as well as forty-seven individual states have all created legislation protecting personal information of individuals. These laws outline a business’ responsibilities after a breach, regulatory requirements not to mention the possibility of lawsuits.

- The average cost per record to a business from a data breach is $194.

- Business that accept credit cards or debit cards may be subject to fines and penalties for violations of the Payment Card Industries Data Security Standards (PCI DSS).

- Claims arising from activity on your website are likely not covered under your General Liability if it concerns intellectual property or activity in a chat room or bulletin board, including social media.

- The Federal Trade Commission estimates that the average time spent resolving a single identity theft is 400 hours. A business owner or partner or board member cannot properly manage their business while resolving an identity theft.

- If the personal credit of a business owner is ruined from an identity theft, that owner may lose the ability to access loans essential to the operation of that business.